The Last date of Income Tax Return is 31st, July, So People are little worried about it. But usually date extends every year, So not to worry and also it can be filled within 10 minutes max if you have required Documents. Before going through the process of filling Income Tax form, We will discuss about few Terminology about Income Tax.

What is Income Tax and Income Tax Return?

Income Tax defined as an annual taxes levied by the federal government and most state governments on individual and business income.

Income Tax Return is a process to determine whether businesses and individuals owe taxes and it is compulsory to file according to law.

What is Financial Year and Assessment Year?

Financial Year (FY) is the year in which you earn your income and pay your taxes on your earned income.

It starts on 1st of April and ends on 31st March every Year.

Assessment Year (AY) is the year followed by your Financial Year in which your income is assessed.

You can take one example as Your income from 1st of April 2018 to 31st of March 2019 is under FY 2018-19 and AY 2019-20.

What is Gross Total Income and Total Income?

Gross Total Income comes under all forms of incomes, including income from salary, property, business or profession, profits or gains, and other sources like interest, etc.

Total Income is the income after deductions under Chapter VI-A(80C and All).

What is Deduction and Exemption?

Deduction is the reduction in total taxable income through benefits under Chapter VI-A, Section 80.

Exemption is the amount after excluding from the gross total income available under Sections 10 or 54. It is the amount deducted

from the income before calculating tax.

Filling Income Tax Return Online

I guess Now we are able to understand all small small terms about income Tax. So lets proceed with the process of filling ITR.

It is very simple. And there are two ways you can fill it.

File ITR through Income Tax Website

- Visit Income Tax Website – Click Here

- Login if you already a user or Register if you are a new user. If you forget your password you can also reset Here

- After successful login you will be redirected to the Dashboard, Where you will get option Filling of Income Tax Return.

- Click on Income Tax Return.

- You will get another Form where you have to fill PAN (prefilled), AY, ITR Form Number, Filling Type and Submission Mode. To know about which ITR Form you applicable for Click Here. For Salaried Person its ITR-1

- After proceeding with Step 5 you will get a new form where you have to fill all details about your income and deductions. One by One fill all and Save and Submit to file. Instructions are also given in First tab of that form. Tabs are given as: Instructions, Part A General Information, Computation of Income and Tax, Tax Details, Taxes paid and Verification, Donations-80G, Donation-80GGA.

- Verify all details and submit.

This is bit complicated for all the new users so Here comes the 2nd easiest way to File ITR.

File ITR through Clear Tax

- Visit Clear Tax Website – Click Here (You will get 50 INR if you visit from this link)

- You will get 2 options Start E- Filing and Upload Form-16 PDF.

- If you have Form-16 (Usually organization will give which you are working for) then choose 2nd Option i.e Upload Form-16 PDF.

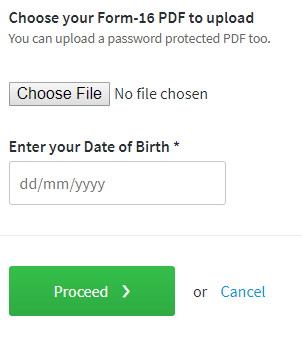

- Now Upload Your Form 16 and fill Date of Birth in format dd/mm/yyyy.

5. Proceed and Enter Password if any.

6. Now Verify your details and Proceed with E-filling (You can also upload more Form 16 if you worked for more than one company).

7. Provide email id(signup/sign-in).

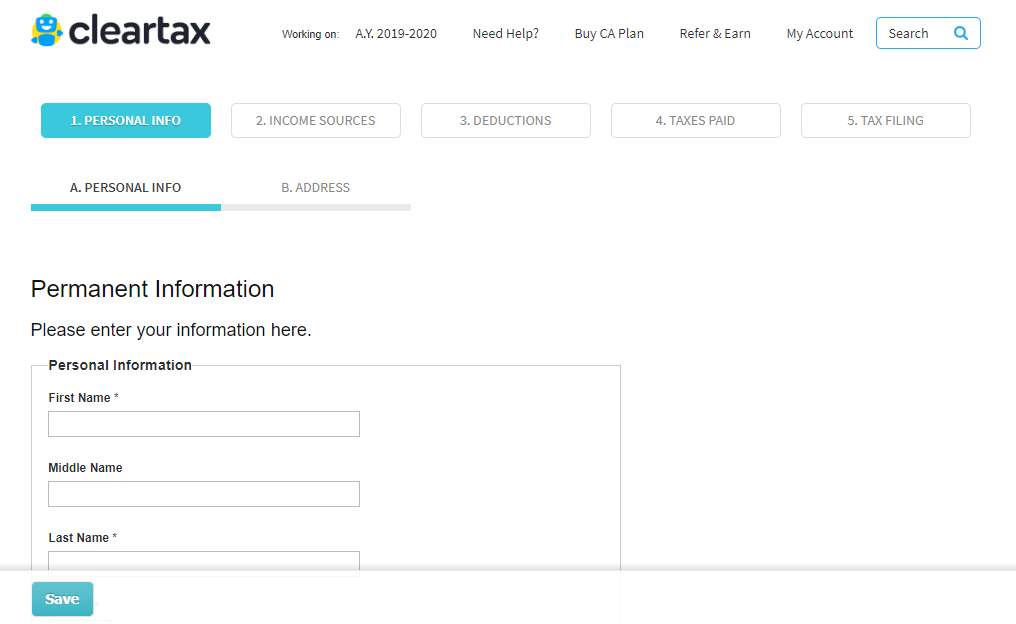

8. Now a simple Pre-filled form will be open.

9. Just fill your required details and proceed next> next(SAVE).

10. Just Click on Saving as you have uploaded the Form 16. This from will take all the required data from Form-16. If there is any other details you wanted to give apart from the Form-16 then you can add otherwise click on save and next. Save and Go to Next do till end unless you have any TDS (26A S Form). If any one has deducted your TDS (Bank, Other Company, etc then you can upload it to save tax) then upload 16A S PDF. To Download the 26A S PDF, Login to Income Tax Portal and then Go to My Account and click on “View Form 26AS (Tax Credit). or Visit Here for more.

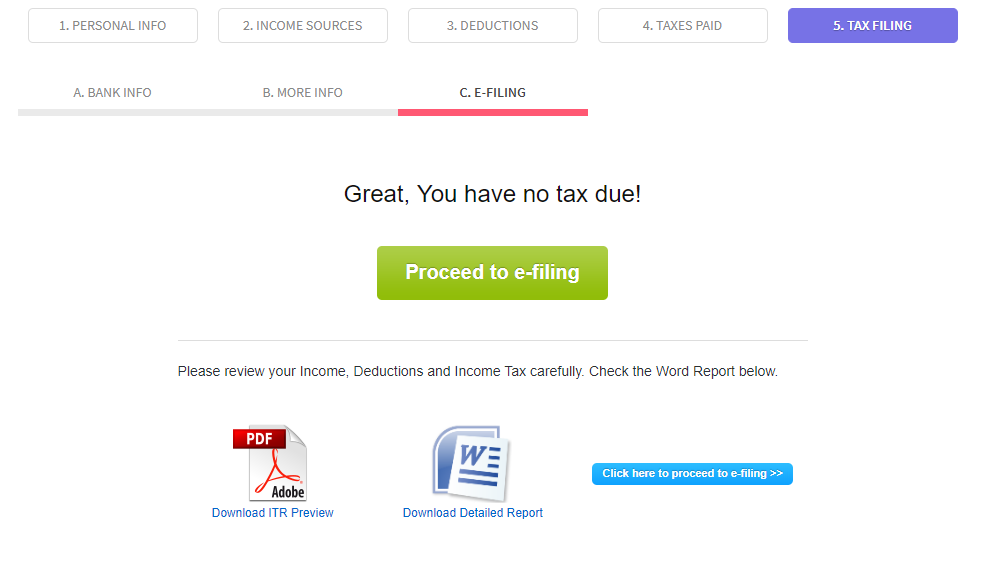

11. After going Save and Next You will end up with Screen like below mentioned where your Tax amount will be shown if any.

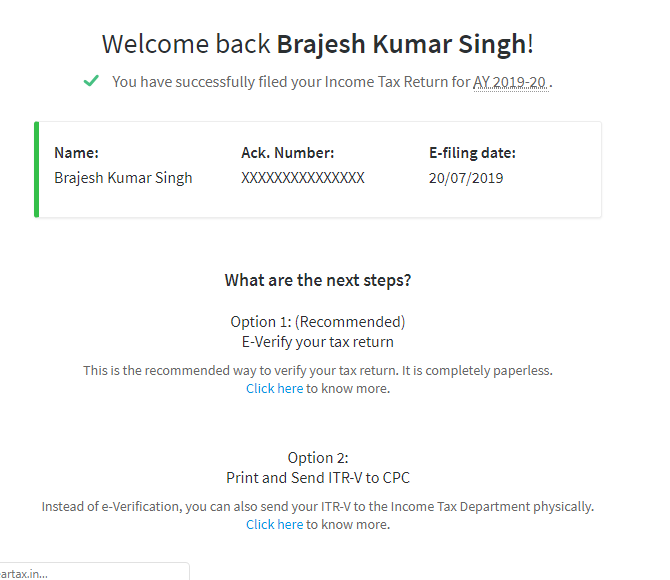

12. Now Proceed to e-Filing. And wait for some time to complete. (OTP Verify if needed). You will get Below Screen after Successful File.

After doing all steps either 1 or 2. You have to Verify it (e verify). For e Verification. Follow the below Process

e- Verification Process

- Login and Go to Dashboard of Income Tax Website: Here

- Click on View Returns /Forms.

- Select Option as Income Tax Return and Submit.

- You will get all the list of Returns you have filed. On the top of that you you will get a option in green button type box ” Click here to view your returns pending for e- verification).

- Click on that and then click on e-Verify (Right Last).

- You can choose out of three option to verify. The last option verify with Aadhaar is easy one. Click on that.

- Click on I would like to Generate Aadhaar OTP now.

- Enter the OTP (You will get in your register mobile no) and click on the agree checkbox and Finally Submit it.

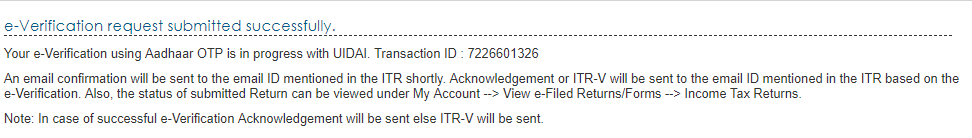

- Once you done with all. You are done with your ITR and you will get Screen like below.

That’s all you have successfully completed your ITR filling. If you process the steps it will be completed in just 10 minutes. You can comment down if you have any doubts and right back to us will try to resolve if possible.

You can also check our other articles like GST revision.

I am glad to be a visitor of this perfect website! , thanks for this rare information! .

Really Appreciate this post, is there any way I can get an alert email whenever you publish a fresh update?

Touche. Sound arguments. Keep up the amazing effort.|

Useful & much needed information

Thanks for Sharing this awesome & useful Information. Really appreciate for your good work…

good article, well written

thanks for good information, much needed

Thanks team for useful information